Fundamental and Technical Analysis: Uncovering the Secrets to Successful Investment Strategies

- Victor Vita

- Jul 24, 2023

- 5 min read

Updated: Sep 11, 2023

As an investor, it is crucial to have a deep understanding of the different approaches to analyzing the stock market. Two common methods used by investors are fundamental analysis and technical analysis. These methods provide valuable insights into the financial health and future prospects of a company, helping investors make informed decisions. In this article, we will demystify fundamental and technical analysis, exploring their benefits, key factors, and principles.

Unlock Your Financial Potential - Enroll Now in 'Learn to Invest' Course! Empower yourself with expert knowledge, master investment strategies, and pave your way to financial success. Don't miss out on this life-changing opportunity. Join us today and embark on a journey towards a prosperous future!

What is fundamental analysis?

Fundamental analysis involves evaluating a company's financial statements, its industry, and the overall economy to determine its intrinsic value. The goal is to assess whether a company is undervalued or overvalued in the market. Fundamental analysts delve into a company's financial statements, such as balance sheets, income statements, and cash flow statements, to gain insights into its revenue, profitability, and growth potential. They also consider macroeconomic factors, market trends, and competitive landscapes to understand the broader context in which the company operates.

Benefits of fundamental analysis

Fundamental analysis provides several benefits to investors. Firstly, it helps identify the value of a company's stock compared to its market price. By evaluating the company's financials, fundamental analysts can determine if the stock is undervalued or overvalued, allowing investors to make decisions based on the stock's potential for future growth. Secondly, fundamental analysis provides a long-term perspective on investments. By understanding the company's financial health and growth prospects, investors can hold onto stocks for extended periods, providing the opportunity for substantial returns. Lastly, fundamental analysis helps investors identify potential risks and opportunities. By analyzing the company's financials and industry trends, investors can anticipate changes in the market and adjust their investment strategies accordingly.

Key factors to consider in fundamental analysis

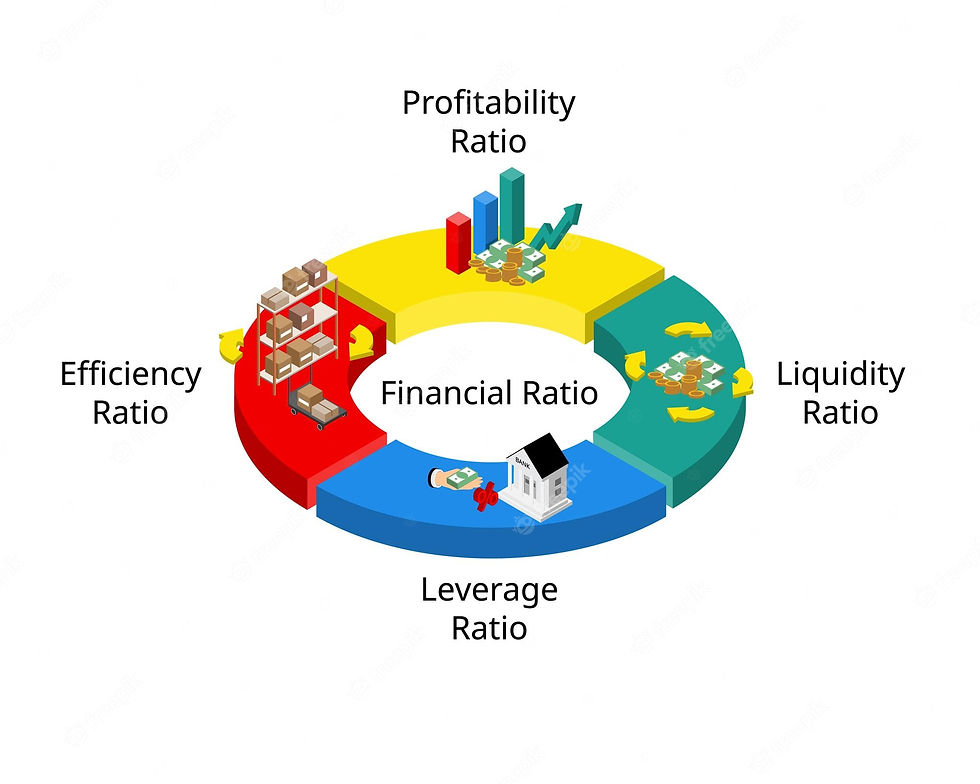

In fundamental analysis, several key factors need to be considered. Firstly, revenue growth is essential to assess a company's potential for future success. By analyzing revenue trends, investors can determine if the company is experiencing consistent growth or facing challenges. Secondly, profitability measures, such as gross profit margin, operating profit margin, and net profit margin, provide insights into a company's ability to generate profits. These measures help investors evaluate the company's efficiency and competitiveness. Thirdly, evaluating a company's debt levels and liquidity is crucial. By analyzing a company's debt-to-equity ratio and current ratio, investors can assess its financial stability and ability to meet short-term obligations.

What is technical analysis?

While fundamental analysis focuses on a company's financials, technical analysis takes a different approach by examining historical price and volume data. Technical analysts believe that past price and volume patterns can help predict future price movements. They use various tools and techniques, such as charts, trend lines, and indicators, to identify patterns and trends. Technical analysts rely on the idea that the market follows certain patterns and that history tends to repeat itself.

Benefits of technical analysis

Technical analysis offers several benefits to investors. Firstly, it provides valuable insights into market trends and investor sentiment. By analyzing historical price and volume data, technical analysts can identify support and resistance levels, which help determine when to buy or sell a stock. Secondly, technical analysis helps investors set specific entry and exit points. By identifying trends and patterns, investors can make more precise decisions, reducing the risk of making impulsive trades. Lastly, technical analysis allows investors to analyze a large number of stocks quickly. With the help of various tools and indicators, investors can screen multiple stocks and focus on those that show promising price movements.

Key principles of technical analysis

In technical analysis, several key principles guide the decision-making process. Firstly, trend analysis is crucial. Technical analysts believe that trends tend to persist, and identifying them can help predict future price movements. They use various tools, such as moving averages and trendlines, to identify trend directions. Secondly, support and resistance levels play a significant role. These levels represent price levels at which a stock has historically had difficulty moving above or below. Technical analysts use these levels to determine potential entry and exit points. Lastly, volume analysis is essential. Technical analysts believe that volume provides insights into the strength of price movements. High volume often accompanies significant price movements, indicating strong market participation.

Fundamental analysis vs. technical analysis - similarities and differences

While fundamental and technical analysis have different approaches, they share some similarities. Both methods aim to provide investors with valuable insights into the stock market. They help investors make informed decisions based on different types of data. Additionally, both methods have their limitations. Fundamental analysis may not capture short-term market fluctuations, while technical analysis may overlook important fundamental factors.

The main difference between the two approaches lies in the type of data they analyze. Fundamental analysis focuses on a company's financials, industry, and economy, while technical analysis examines historical price and volume data. Fundamental analysis is more suitable for long-term investors looking for value and growth potential, while technical analysis is often used by short-term traders seeking to capitalize on price movements.

Combining fundamental and technical analysis for better investment strategies

While fundamental and technical analysis have their strengths and weaknesses, combining the two approaches can lead to more robust investment strategies. By incorporating fundamental analysis, investors can identify undervalued stocks with strong growth potential. Technical analysis can then be used to determine the best entry and exit points based on historical price patterns. This combination allows investors to make more informed decisions and potentially increase the likelihood of successful investments.

Tools and resources for fundamental and technical analysis

Several tools and resources are available to aid in fundamental and technical analysis. For fundamental analysis, financial websites, such as Bloomberg and Yahoo Finance, provide access to company financials, earnings reports, and industry news. Additionally, fundamental analysts can use valuation models, such as the discounted cash flow (DCF) method, to estimate a company's intrinsic value. For technical analysis, charting software, such as TradingView and MetaTrader, offer various technical indicators and charting tools. These tools allow investors to analyze historical price and volume data and identify patterns and trends.

Common mistakes to avoid in fundamental and technical analysis

While fundamental and technical analysis can be powerful tools, there are common mistakes that investors should avoid. Firstly, overreliance on a single method can lead to biased decision-making. It is important to consider both fundamental and technical factors to gain a comprehensive understanding of a company and its potential. Secondly, ignoring risk management can be detrimental to investment strategies. Setting stop-loss orders and diversifying the portfolio can help mitigate potential losses. Lastly, emotional decision-making should be avoided. Successful investing requires discipline and objectivity, ensuring decisions are based on data and analysis rather than emotions.

Conclusion: The importance of a balanced investment strategy

In conclusion, fundamental and technical analysis are two approaches that provide valuable insights into the stock market. Fundamental analysis focuses on a company's financials and industry, while technical analysis examines historical price and volume data. By combining these approaches, investors can make more informed decisions and potentially increase the likelihood of successful investments. However, it is crucial to avoid common mistakes and maintain a balanced investment strategy. Understanding the strengths and weaknesses of each approach and incorporating risk management principles can lead to more successful investment outcomes.

Remember, successful investing requires continuous learning and adaptation. Stay informed, analyze data, and make decisions based on a comprehensive understanding of the market. With a balanced investment strategy and the right tools, you can uncover the secrets to successful investment strategies.

Comments