Investment Securities: A Comprehensive Guide

- Victor Vita

- Jul 22, 2023

- 6 min read

Updated: Jul 28, 2023

Investing is a crucial step towards building wealth and securing your financial future. When it comes to investing, one of the key concepts to understand is investment securities. In this comprehensive guide, we will explore the different types of investment securities, their characteristics, and how you can invest in them. Whether you're a seasoned investor or just starting out, this guide will provide you with the knowledge and insights you need to make informed investment decisions.

Unlock Your Financial Potential - Enroll Now in 'Learn to Invest' Course! Empower yourself with expert knowledge, master investment strategies, and pave your way to financial success. Don't miss out on this life-changing opportunity. Join us today and embark on a journey towards a prosperous future!

Understanding Investment Securities

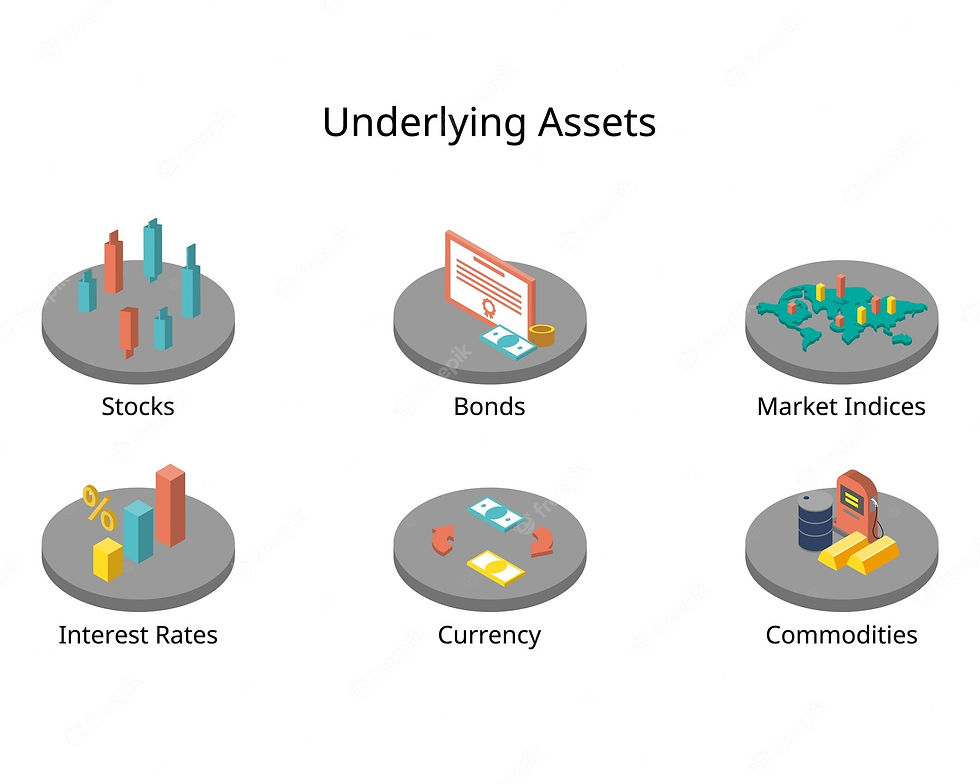

Investment securities are tradable financial assets that are bought and held with the expectation of generating a return. These securities can take various forms, each offering unique features and potential benefits. Generally, investment securities can be classified into three main categories: equity securities, debt securities, and derivatives.

1. Equity Securities

Equity securities, also known as stocks, represent ownership in a company. When you purchase stocks, you become a shareholder and have a claim on the company's assets and earnings. Stocks offer the potential for capital appreciation and dividends, making them popular among investors seeking long-term growth. However, they also come with higher risk compared to other types of securities.

2. Debt Securities

Debt securities, such as bonds, are essentially loans made by investors to governments, municipalities, or corporations. When you invest in bonds, you become a creditor and receive periodic interest payments until the bond matures. At maturity, the issuer repays the principal amount. Bonds are generally considered less risky than stocks, making them ideal for conservative investors seeking regular income and capital preservation.

3. Derivatives

Derivatives are financial instruments whose value is derived from an underlying asset, such as stocks, bonds, or commodities. Examples of derivatives include futures contracts, options, and swaps. Derivatives provide investors with the opportunity to speculate on the price movements of the underlying assets. However, they are complex and carry a higher degree of risk, making them more suitable for experienced investors.

It's important to note that securities are traded on various platforms, including stock markets and secondary markets. The U.S. Securities and Exchange Commission (SEC) regulates the sale and trade of securities to ensure fair and transparent markets.

Common Types of Investment Securities

Now that we have a basic understanding of investment securities, let's explore some of the most common types that you may encounter in your investment journey.

1. Stocks

Stocks, as mentioned earlier, represent ownership in a company. By purchasing stocks, you become a partial owner and have the potential to benefit from the company's growth and profitability. Stocks can be further categorized into different types, such as common stocks and preferred stocks.

Common stocks grant shareholders voting rights and the opportunity to receive dividends. Preferred stocks, on the other hand, offer a fixed dividend payment but usually do not provide voting rights. Investing in stocks can be done through individual stock purchases, stock funds, or exchange-traded funds (ETFs).

2. Bonds

Bonds are debt securities issued by governments, municipalities, or corporations to raise capital. When you invest in bonds, you lend money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are generally considered less volatile than stocks and can provide a steady stream of income. Some common types of bonds include corporate bonds, municipal bonds, and U.S. Treasury bonds.

3. Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities. These funds are managed by professional fund managers who make investment decisions on behalf of the investors.

Mutual funds can focus on various asset classes, such as stocks, bonds, or a combination of both. They offer investors the benefit of diversification and professional management.

4. Exchange-Traded Funds (ETFs)

Exchange-Traded Funds (ETFs) are similar to mutual funds in that they pool money from multiple investors to invest in a diversified portfolio. However, ETFs trade on stock exchanges like individual stocks. They are passively managed and often track specific market indices. ETFs can provide investors with exposure to a wide range of assets, including stocks, bonds, and commodities.

5. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) are investment vehicles that own and operate income-generating real estate properties. By investing in REITs, individuals can gain exposure to the real estate market without the need to directly own and manage properties. REITs can offer regular income through rental payments and potential capital appreciation.

6. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are time deposits offered by banks and credit unions. When you invest in a CD, you agree to leave your money with the financial institution for a specified period in exchange for a fixed interest rate. CDs are considered low-risk investments and can provide a predictable stream of income. However, they generally offer lower returns compared to other types of securities.

7. Options and Futures

Options and futures are derivatives that allow investors to speculate on the future price movements of an underlying asset. Options give investors the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period. Futures contracts, on the other hand, obligate the buyer to purchase or sell an asset at a predetermined price on a specified future date. Both options and futures can be used for hedging or speculative purposes.

How to Invest in Investment Securities

Now that we have explored the different types of investment securities, let's discuss how you can start investing in them. There are several avenues available for investing in securities, each with its own advantages and considerations.

1. Brokerage Accounts

Brokerage accounts provide direct access to the investment market. They allow investors to buy and sell securities through a brokerage firm. Opening a brokerage account is relatively straightforward, and you can choose from a variety of online brokerages. When selecting a brokerage, consider factors such as fees, available securities, research tools, and customer support.

2. Retirement Accounts

Retirement accounts, such as Individual Retirement Accounts (IRAs) and 401(k) plans, offer tax advantages for long-term investing. These accounts can provide access to a wide range of investment securities, including stocks, bonds, and mutual funds. Contributions to retirement accounts may be tax-deductible or tax-free, depending on the type of account and your eligibility.

3. Robo-Advisors

Robo-advisors are online platforms that use algorithms and computer models to provide automated investment advice. These platforms typically offer a range of investment portfolios tailored to individual investor goals and risk tolerance. Robo-advisors can be a convenient and cost-effective option for those who prefer a hands-off approach to investing.

4. Financial Advisors

Working with a financial advisor can provide personalized investment advice and guidance. Financial advisors can help assess your financial goals, risk tolerance, and develop a customized investment strategy. They can also assist in selecting suitable investment securities and monitor your portfolio over time. When choosing a financial advisor, consider their qualifications, experience, and fees.

5. Employer-Sponsored Plans

Many employers offer retirement plans, such as 401(k) plans, which provide a convenient way to invest in securities. These plans often offer a selection of investment options, including mutual funds and target-date funds. Some employers may even match a portion of your contributions, providing an additional incentive to participate.

6. Education Savings Accounts

Education savings accounts, such as 529 plans, are specifically designed to help save for education expenses. These accounts offer tax advantages and can be used to invest in a variety of securities, such as mutual funds or ETFs. 529 plans can be a great way to save for your child's education while potentially benefiting from investment growth.

The Importance of Diversification

Regardless of the investment securities you choose, diversification plays a crucial role in managing risk and maximizing potential returns. Diversifying your portfolio involves spreading your investments across different asset classes, sectors, and geographic regions. By diversifying, you reduce the impact of any single investment on your overall portfolio, potentially mitigating losses and improving long-term performance.

It's important to note that investing in securities involves risks, including the potential loss of principal. Before making any investment decisions, it's advisable to carefully consider your financial goals, risk tolerance, and seek professional advice if needed.

Conclusion

Investment securities are essential tools for building wealth and achieving financial goals. By understanding the different types of investment securities and how to invest in them, you can make informed decisions that align with your investment objectives. Whether you choose stocks, bonds, mutual funds, or other investment vehicles, diversification and a long-term perspective are key to successful investing.

Remember, investing is a journey that requires continuous learning and adjustment. Stay informed, monitor your investments regularly, and consult with professionals when needed. With a well-rounded investment strategy and a disciplined approach, you can navigate the world of investment securities and work towards achieving your financial aspirations.

Additional Information: When investing in securities, it's important to conduct thorough research, assess your risk tolerance, and consider your investment goals. Be sure to consult with a financial advisor or professional before making any investment decisions.

Comments