A Comprehensive Guide to Investing in Bonds: Everything You Need to Know

- Victor Vita

- Jul 22, 2023

- 8 min read

Updated: Jul 28, 2023

## What are bonds and why should you consider investing in them?

Bonds are fixed-income securities that are issued by governments, municipalities, and corporations to raise capital. When you invest in bonds, you essentially lend your money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are considered a relatively safer investment compared to stocks because of their fixed income and the stability of the issuer.

Investing in bonds can offer several benefits. Firstly, bonds provide a steady stream of income through regular interest payments. This can be particularly attractive for investors who are looking for a stable income source or those who are approaching retirement. Bonds also provide diversification to your investment portfolio, as they tend to have a low correlation with stocks. This means that when stock prices are volatile, bonds can act as a buffer to help protect your capital. Additionally, bonds are generally less volatile than stocks, making them a suitable choice for conservative investors.

Unlock Your Financial Potential - Enroll Now in 'Learn to Invest' Course! Empower yourself with expert knowledge, master investment strategies, and pave your way to financial success. Don't miss out on this life-changing opportunity. Join us today and embark on a journey towards a prosperous future!

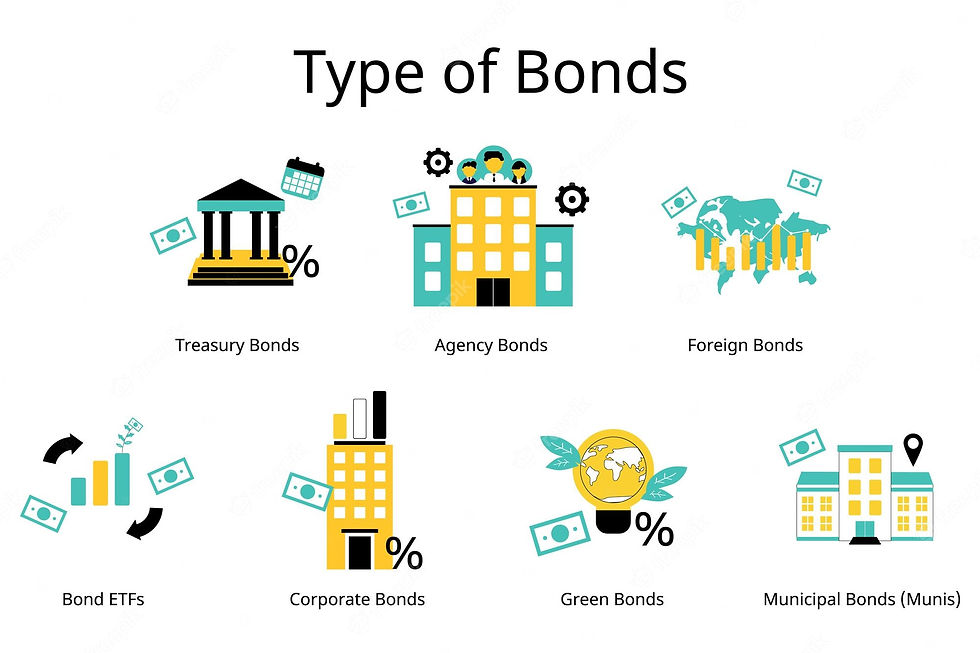

Types of bonds and their features

There are various types of bonds available for investment, each with its own unique features.

Government Bonds: These bonds are issued by the government and are considered to be the safest type of bond. They are backed by the full faith and credit of the government, which means that the risk of default is extremely low. Government bonds can be further categorized into treasury bonds, treasury bills, and treasury notes, depending on their maturity.

Municipal Bonds: Municipal bonds are issued by state and local governments. They are used to finance public infrastructure projects such as schools, roads, and hospitals. One of the key advantages of investing in municipal bonds is that the interest income is often exempt from federal and state taxes, making them a tax-efficient investment.

Corporate Bonds: Corporate bonds are issued by corporations to raise capital for various purposes, such as expansion or debt refinancing. They offer higher interest rates compared to government or municipal bonds, but they also come with a higher level of risk. The creditworthiness of the corporation issuing the bond plays a crucial role in determining the risk associated with corporate bonds.

Advantages and disadvantages of investing in bonds

Investing in bonds has its own set of advantages and disadvantages that should be carefully considered before making any investment decisions.

On the positive side, bonds provide a predictable stream of income through regular interest payments. This can be especially beneficial for retirees or those who are looking for a steady income source. Bonds also offer a lower level of volatility compared to stocks, making them a suitable choice for conservative investors who prioritize capital preservation.

However, there are also some drawbacks to investing in bonds. One of the main disadvantages is the relatively lower potential for capital appreciation compared to stocks. While bonds provide a fixed income, they do not offer the same growth potential as stocks. Additionally, bonds are subject to interest rate risk. When interest rates rise, the value of existing bonds tends to decrease, which can result in capital losses for bondholders. Finally, bonds are not completely risk-free. There is always a chance of default by the issuer, although this risk is generally lower for government and municipal bonds.

How to invest in bonds: a step-by-step guide

Investing in bonds can be a straightforward process if you follow these steps:

Determine your investment goals: Before investing in bonds, it's important to identify your investment goals and time horizon. This will help you choose the appropriate type of bonds and the duration of your investment.

Educate yourself about bonds: Familiarize yourself with the different types of bonds, their features, and the risks associated with bond investing. Understanding the basics will help you make informed investment decisions.

Establish your risk tolerance: Assess your risk tolerance to determine the appropriate mix of bonds for your investment portfolio. Consider factors such as your age, financial situation, and investment objectives.

Choose a reputable broker or financial advisor: Find a trustworthy broker or financial advisor who can help you navigate the bond market and provide guidance on suitable investment options.

Research bonds: Conduct thorough research on the bonds you are interested in. Consider factors such as the issuer's creditworthiness, the bond's yield, maturity, and any associated fees.

Diversify your bond portfolio: Spread your investment across different types of bonds to reduce the risk of exposure to a single issuer or industry. Diversification can help mitigate potential losses and maximize returns.

Monitor your investments: Regularly review your bond investments to ensure they align with your investment goals. Stay informed about any changes in the market or the issuer's financial health that may impact your investment.

Consider professional advice: If you are unsure about investing in bonds on your own, seek professional advice from a financial advisor. They can provide personalized guidance based on your specific financial situation and investment objectives.

Factors to consider when choosing bonds to invest in

When selecting bonds to invest in, there are several key factors that you should consider:

Creditworthiness of the issuer: Assess the creditworthiness of the issuer to determine the risk of default. Credit rating agencies such as Moody's and Standard & Poor's provide ratings that can help you evaluate the issuer's financial stability.

Yield: Consider the yield of the bond, which indicates the return you can expect from your investment. Higher-yielding bonds typically come with higher risk.

Maturity: Evaluate the maturity date of the bond and determine whether it aligns with your investment goals and time horizon. Short-term bonds have lower interest rate risk but offer lower yields, while long-term bonds offer higher yields but are more susceptible to interest rate fluctuations.

Tax implications: Understand the tax implications of investing in bonds. Some bonds, such as municipal bonds, offer tax advantages, while others may be subject to federal and state taxes.

Liquidity: Assess the liquidity of the bond, which refers to how easily it can be bought or sold. Highly liquid bonds can be more easily traded, providing flexibility to adjust your investment strategy if needed.

Fees: Consider any fees associated with buying or selling bonds, such as brokerage fees or transaction costs. These fees can impact your overall return on investment.

By carefully evaluating these factors, you can make informed decisions and choose bonds that align with your investment goals and risk tolerance.

Bond investment strategies for different goals

The investment strategy for bonds can vary depending on your financial goals and risk appetite. Here are a few common strategies:

Income-focused strategy: If your primary goal is to generate a steady stream of income, you can focus on investing in bonds with higher yields. This strategy is suitable for retirees or investors who rely on fixed income for their expenses.

Diversification strategy: Diversifying your bond portfolio can help spread the risk and maximize returns. Allocate your investments across different types of bonds, such as government, municipal, and corporate bonds, as well as across different sectors and maturities.

Laddering strategy: Laddering involves investing in bonds with staggered maturities. This strategy helps mitigate the impact of interest rate fluctuations and provides a regular stream of income as bonds mature.

Duration strategy: Adjusting the duration of your bond investments can help manage interest rate risk. Longer-duration bonds are more sensitive to interest rate changes, while shorter-duration bonds are less affected.

Active management strategy: If you have the time and expertise, you can actively manage your bond portfolio by regularly monitoring and adjusting your investments based on market conditions and economic outlook.

It's important to note that these strategies are not exhaustive, and the most suitable strategy for you will depend on your individual circumstances and investment goals.

Risks and precautions associated with investing in bonds

While investing in bonds can offer stability and income, it's essential to be aware of the risks involved. Here are some key risks and precautions to consider:

Interest rate risk: Bonds are sensitive to changes in interest rates. When interest rates rise, bond prices typically fall, which can result in capital losses if you need to sell your bonds before maturity. To mitigate this risk, consider investing in bonds with shorter maturities or diversify your bond portfolio.

Credit risk: There is always a risk of default by the issuer, especially with corporate bonds. Assess the creditworthiness of the issuer before investing and consider diversifying your investments across different issuers to reduce the impact of a potential default.

Inflation risk: Bonds are fixed-income investments, which means that the purchasing power of the interest income and principal may be eroded by inflation over time. To hedge against inflation, consider investing in inflation-protected bonds or diversify your portfolio with other assets that have the potential to outpace inflation.

Liquidity risk: Some bonds may have low liquidity, making it difficult to sell them at a fair price when needed. Evaluate the liquidity of the bonds you are considering and consider investing in bonds that are traded on active markets to ensure easy access to your investment.

Reinvestment risk: When a bond matures or the interest payments are received, you may face reinvestment risk if the prevailing interest rates are lower than the rate of the original investment. This can impact the overall return on your investment. To mitigate this risk, consider laddering your bond investments or diversifying into other fixed-income assets.

It's important to carefully assess these risks and take appropriate precautions when investing in bonds. Consult with a financial advisor if you need assistance in understanding and managing the risks associated with bond investing.

Tips for successful bond investing

To make the most of your bond investments, consider these tips:

Diversify: Diversify your bond portfolio to reduce risk and maximize returns. Invest in bonds from different issuers, sectors, and maturities.

Stay informed: Keep yourself updated on market conditions, economic indicators, and any news that may impact the bond market. This will help you make informed investment decisions.

Consider professional advice: If you are new to bond investing or unsure about making investment decisions on your own, seek guidance from a financial advisor. Their expertise can help you navigate the bond market and make suitable investment choices.

Evaluate costs: Consider the costs associated with buying and selling bonds, such as brokerage fees and transaction costs. Minimizing costs can improve your overall investment returns.

Review your portfolio: Regularly review your bond portfolio to ensure it aligns with your investment goals and risk tolerance. Make adjustments as needed to maintain a well-balanced portfolio.

Reinvest interest income: If you don't need the regular interest income from your bonds, consider reinvesting it to compound your returns over time. This can help accelerate the growth of your investment.

Monitor credit ratings: Stay updated on the credit ratings of the issuers of your bonds. If the creditworthiness of an issuer deteriorates, it may be wise to reassess your investment and consider selling the bond.

Remember that successful bond investing requires patience, research, and a long-term perspective. It's important to have realistic expectations and understand that bond investments are generally more conservative in nature compared to stocks.

Resources for further education on bond investing

If you're interested in delving deeper into the world of bond investing, here are some resources that can help expand your knowledge:

Books: Consider reading books such as "The Bond Book" by Annette Thau and "Fixed Income Securities: Tools for Today's Markets" by Bruce Tuckman and Angel Serrat. These books provide comprehensive insights into bond investing.

Online courses: Platforms like Coursera and Udemy offer online courses on bond investing. Look for courses that cover topics such as bond valuation, risk management, and portfolio construction.

Financial news websites: Stay updated on the latest bond market news and trends by regularly visiting financial news websites such as Bloomberg, CNBC, and Reuters. These websites often provide analysis and expert opinions on bond investing.

Bond market research reports: Access research reports from reputable financial institutions and bond market analysts. These reports often provide valuable insights and recommendations on bond investment opportunities.

Financial advisors: Consult with a financial advisor who specializes in bond investments. They can provide personalized guidance and help you navigate the complexities of the bond market.

Conclusion

Investing in bonds can be a valuable addition to your investment portfolio, offering stability, income, and diversification. By understanding the basics of bond investing, evaluating the risks and rewards, and following a disciplined approach, you can make informed investment decisions.

Remember to assess your investment goals, risk tolerance, and time horizon before investing in bonds. Consider the various types of bonds available, their features, and the factors that influence their performance. By following sound investment strategies and staying informed about market conditions, you can enhance your chances of successful bond investing.

Start exploring the world of bonds today and reap the benefits of this versatile investment instrument.

Note: The information provided in this article is for educational purposes only and should not be considered financial advice. Consult with a professional financial advisor before making any investment decisions.

Comments